One of the things that attracted me to the blockchain revolution was its principles. I’m writing this article so we don’t forget them. It’s important for us to return to these principles, because they represent independence.

On January 3rd, 2009, Satoshi Nakomoto hardcoded this message into the Genesis Block of bitcoin:

“The Times 03/Jan/2009 Chancellor on brink of second bailout for banks”

That was the day’s headline from The London Times, as the government continued to bail out banks from the 2008 financial meltdown. That bailout represented a closed system between centralized institutions—banks and governments—that had both failed us.

Bitcoin represented a different model: a decentralized system, where the people owned the money. More than that, bitcoin was global money, beyond the reach of any government. Finally, it was private money, protected by cryptography.

The roots of bitcoin go much deeper, to the cypherpunk movement of the 1990s, epitomized in A Cypherpunk’s Manifesto by Eric Hughes. In just 860 tightly-crafted words, Hughes articulated a vision for a world in which privacy was a basic human right.

Privacy, he argued, was not secrecy: “A private matter is something one doesn’t want the whole world to know, but a secret matter is something one doesn’t want anybody to know.” We all have things we’d rather keep private (which is why we wear pants).

The cypherpunk movement, which thrived on mailing lists and message boards, attracted a motley crew of techno-libertarians, who generally valued “personal privacy and personal liberty above all other considerations.”

And the cypherpunk mailing list is where Satoshi Nakamoto first published his white paper for bitcoin.

Principle 1: Everyone Has Private Parts

The cypherpunks were introduced to the world by tech writer Steven Levy in a 1993 Wired magazine cover story titled Crypto Rebels:

“[They] hope for a world where an individual’s informational footprints — everything from an opinion on abortion to the medical record of an actual abortion — can be traced only if the individual involved chooses to reveal them. There is only one way this vision will materialize, and that is by widespread use of cryptography. Is this technologically possible? Definitely.”

I still have an original copy of this issue, which made a huge impact on me. I had never thought about privacy as being something worth fighting for—what did I have to hide? Eventually I realized that most of us want privacy around our medical history, financial background, personal issues, and on and on.

Most of us don’t want Alexa listening in on every personal conversation, broadcasting to anyone who can figure out how to hack in. Most of us don’t want the government peering into our bedroom through our webcam. All this happens, of course, because we have not claimed our right to privacy.

In fact, our privacy is under fire now more than ever. Social media sites like Facebook know everything about you—including algorithms to identify your face. Data brokers like Equifax are still hoarding your financial history, without your permission. And Alexa is listening.

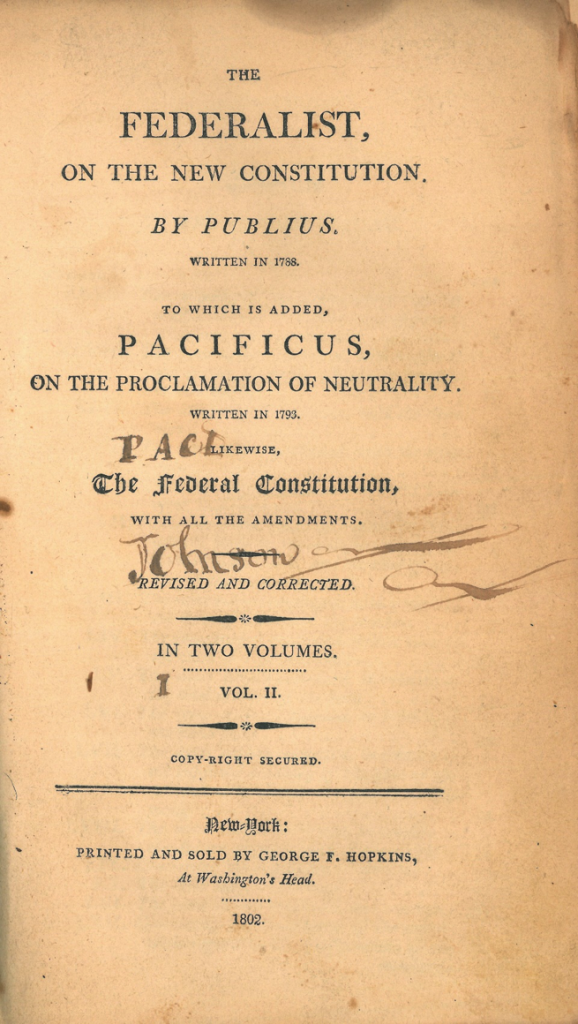

While privacy can certainly be used to hide evil, it can also be used to champion good. The Federalist Papers were written by Alexander Hamilton, James Madison, and John Jay to encourage support for the United States Constitution—but published anonymously.

In other words, privacy is in the DNA of the United States of America.

Principle 2: Power to the Peeps

But the United States is a centralized institution. The founders of this country wisely tried to balance power by creating the executive, legislative, and judicial branches, which serve as a check on centralized control.

One thing got more and more centralized, however: money.

It’s not just a meme: according to Oxfam, the richest 1% have more than the other 99% of us. We need a better financial system, one that lets us send and receive money as simply as sending email. We need to get money to the 7 billion people on earth, including the 1.5 billion that are unbanked.

Money is power. So when everyone has access to money, everyone has access to power. Money for the people means power for the people.

This is why bitcoin is decentralized: a distributed network that anyone can join, making money that anyone can buy. The ultimate check on power is a distributed network, like the Internet. Just as no one “owns” the Internet, no one can “own” a decentralized currency like bitcoin. We all do.

Decentralization, like democracy, is a noble goal. But in the real world, someone has to write the code for bitcoin. Someone has to solve the problems of bitcoin: its poor scalability, rising fees, and outrageous energy consumption. Someone has to step up to “own” bitcoin.

Just as government is the tricky art of managing a democracy, governance is the tricky art of managing decentralized networks. The Internet has developed governing bodies, such as ICANN (which organizes domain names) and the Internet Engineering Task Force (a loosely organized body of smart people). Blockchain will need to do the same.

It’s this spirit of decentralization that we’re after. Open source software, consortiums like Hyperledger, and events like Unconferences capture the decentralized ethos of blockchain technology. (We should look skeptically at “permissioned” or “private” blockchains; why not just use a centralized database?)

The rule of thumb is: the more people we invite to the party, the better the party. (With the caveat that the party may need some bouncers.) What we want is a planetary party, a party for the planet.

Principle 3: Earthlings First

Bitcoin was envisioned as global currency for a global economy. One money for one world. It seems inevitable, doesn’t it?

We can still use our dollars and Euros and rupees, but these will eventually be subsumed by a blockchain-based global currency. Similarly, we can still be proud members of our tribe, but we must first identify with the human race.

We are Americans second, humans first. Britons second, humans first. Indians second, humans first.

This is a different story than we hear in today’s political climate, which is increasingly 2D, increasingly black and white: us vs. them, one party vs. the other, isolationists vs. immigrants.

With blockchain, we’re moving out of 2D into 3D. Living in the third dimension isn’t just about seeing things in shades of grey; it’s about unlocking another dimension of possibilities. Politicians are playing checkers; we’re playing chess.

Isn’t it ironic? Here we are, the decentralized blockchain community, wasting the last year waiting on permission from centralized government institutions like the SEC. Permission! Did the American colonists wait on permission from the King before declaring their independence?

Those early Americans thought in another dimension. They thought about something outside the 2D world of subjects and King. They thought about independence. They thought in 3D.

To think globally is to think about being a part of something much bigger than our country. That’s what’s happening now: a wave of human emotion, bound together by the Internet, financed by a new kind of global money.

Humans first. Earthlings first.

The Fist of Justice

Our Blockchain Investor’s Manifesto has been distributed to thousands of blockchain conference attendees worldwide (you’ll get a copy when you sign up for our newsletter). We cannot print enough of them: people devour them like free cake in the office break room.

On the cover is this illustration of a fist. It is not a fist of violence, it is a fist of justice. A fist of solidarity, to bring wealth to where it is most needed, to open the floodgates of money around the world — and when the world prospers, so do we.

Money for everyone. Blockchain for everyone.

I’ll close with a funny story: I was stopped by an airport TSA agent for a random bag check. When he unzipped my luggage, a hundred of these manifestos sprang out. After he dried his pants, the TSA agent asked, “You’re into blockchain? I just started mining Ethereum.”

Even a centralized government is getting swept up in the wave of decentralization. No one can stop the wave of freedom that’s coming. All we can do is ride it.

Sign up here to get more blockchain intelligence and insight in our free weekly newsletter.