Big news on the blockchain front: The U.S. Securities and Exchange Commission has made a proposal that would allow blockchain projects to once again thrive.

Hester Peirce, the most forward-thinking SEC official on blockchain, put forth a proposal outlining a three-year “safe harbor” for new blockchain projects that would give them “run room” before worrying about securities law. Her proposal would also create “best practices” that new projects would need to follow, ensuring more rigor for project creators and more protection for investors.

You can read the full proposal here, but below we’ll explain the proposal in plain language, and why it benefits both blockchain investors and blockchain projects. First, let’s explain why it’s needed.

The ICO Boom

2017 was the year of the Initial Coin Offering. Entrepreneurs saw they could fund new blockchain projects by issuing “tokens” (i.e., blockchain-based units of value) that investors could buy and sell, as a startup company would issue shares of stock. Importantly, these were not shares of stock: you didn’t own a piece of the company, just a token.

As new digital exchanges emerged to trade these tokens, and the price of many tokens begin to reach stratospheric heights, this formed a hype cycle. Entrepreneurs saw an easy way to raise money for a new project; investors saw an easy way to make money, because so many token holders were getting rich. Fueled by a lot of hot air, the bubble began to rise.

In 2018, at the height of blockchain mania, regulators and lawyers began to indicate that maybe these tokens really were like stocks, and should fall under the same laws. And with that, the bubble popped.

The Crypto Winter of 2018

Blockchain innovation became a confusing morass of obscure securities laws overseen by poorly-informed lawyers. To make things worse, securities laws vary between countries. Imagine creating a website where only residents from certain countries could access the site. The model doesn’t work.

What’s more, blockchain evolves quickly. So a token may start out with one purpose (funding the project), then evolve into something else (becoming a payment for using the network).

In fact, this is what happened with Ethereum. Originally, ether was used to raise funds to create the Ethereum network (which is pretty clearly a security, like a stock). But then ether became the “payment” for using the Ethereum network, like the in-game currency that powers the network.

Because of this “regulatory uncertainty” (two words we hope to never hear again), the torrent of blockchain innovation slowed to a trickle, and that trickle slowed to a freeze. Thus followed the great Crypto Winter of 2018. Blockchain projects went into hibernation. Startups huddled together for warmth, foraging for food and enduring the bitter weather.

Then came Hester Peirce’s proposal.

The New Proposal

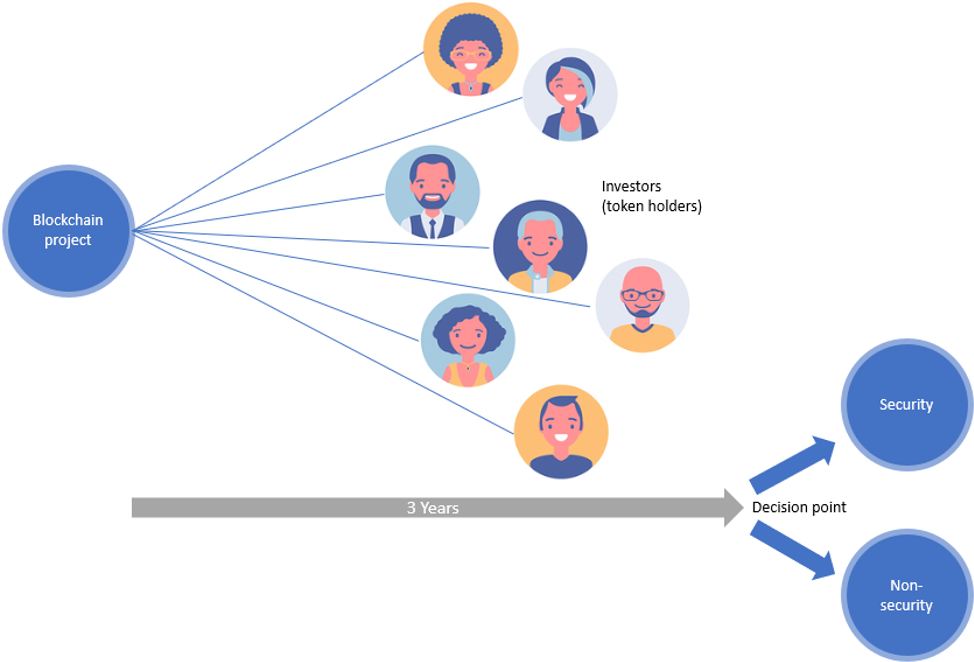

Like all good ideas, it seems obvious when you hear it. Allow U.S. blockchain projects to have a three-year safe harbor, at the end of which they will be classified as securities (or not).

In plain language, this means that entrepreneurs can launch new blockchain projects—with best practices in place, explained below—without worrying about whether their new token is a security. They can focus on building the network, building the community, building the blockchain.

Investors can buy into these new tokens, without worrying about whether they are breaking an outdated securities law. They can buy, sell, and trade these tokens for three years, after which their holdings will be classified as securities (or not).

In this three year “grace period,” a few things might happen.

The token might become a security. It might look like a stock, in which case the investors in the token would be investors in the project, and receive similar benefits as, say, a corporate shareholder.

The token might not be a security. Like Ethereum, it might become something more like an “in-game currency,” a means of payment for using the blockchain network, in which case it would still be tradeable via digital exchanges, but not legally classified as a security.

The project might not go anywhere. Most blockchain projects, like most startups, are not going to get traction. So early investors—like early investors of any company—might have tokens that are essentially worthless. This is the risk of being an early investor.

Peirce’s proposal elegantly solves a number of problems:

- It allows blockchain innovation to flow again. New projects now have a way to raise meaningful financing—and some room to run.

- It allows the U.S. to take the lead. By creating a three-year “sandbox” for innovation, the U.S. can get a rapid head start among major countries on building out its blockchain ecosystem.

- It buys the SEC three years. The legal frameworks for clearly defining securities vs. non-securities won’t have to be decided for another three years.

- It helps solve the chicken-or-egg problem. Blockchains are built around network effects. That means you need a lot of people using the token for it to have value—but if you’re limited in who can own the token, you can’t get a lot of people using it. This proposal allows entrepreneurs to “kickstart” the network with an early burst of investors, allowing entrepreneurs to begin building a community, thus solving the chicken-or-egg problem.

- It begins to define blockchain best practices. Pierce also outlines some common-sense rules that new blockchain projects will need to follow:

- SEC compliance. This is not “launch a crypto project from your bedroom.” Entrepreneurs will still need to follow the standard SEC legal framework for new offerings (think a Regulation D offering).

- Team disclosures. Blockchain projects will need to list “the names and relevant experience, qualifications, attributes or skills” of the initial development team—all welcome details for users of our Blockchain Investor Scorecard.

- Project transparency. Projects will need to be open source, with a publicly searchable transaction history, including disclosing how many tokens have been paid to founders. Importantly, the project website will need to explain how the “tokenomics” work, providing transparency on token supply and mechanics.

Download Our Guide to the SEC Proposal

With the help of our Boston-based blockchain community, we have put together a guide to Commissioner Peirce’s proposal, filling in some of the details and helping define whether a blockchain project is decentralized.

You can download our guide, Born in the USA, by filling out the form below.