Today we’re proud to introduce THE HEALTH AND WEALTH PORTFOLIO. It’s four companies that we think will do exceptionally well in the coming years, in the aftermath of COVID-19.

In brief, these four companies are The Clorox Company (CLX), Amazon.com (AMZN), Zoom Video Communications (ZM), and Netflix, Inc. (NFLX).

We’re all about blockchain investing, not stock picking. But you’ll recall that our Blockchain Believers Portfolio (which is looking better than ever) has the majority of holdings in stocks and bonds.

As the stock market implodes, there is more opportunity than ever — provided you are willing to buy and hold for the long term. (It’s going to be quite a while before the smoke clears.)

As we continually preach, you’ve got to zig while everyone else is zagging. Right now, everyone is zagging for the exit. Time to zig.

To beat the market, you must bet against the market. This is common sense. Here are four bets you might want to consider.

The Coronapocalypse

First, a quick story. I was due to speak at several events this week as part of Boston Blockchain Week, including the Boston Fed. All canceled.

Next week, I was scheduled to speak at the Global Blockchain Expo, the huge technology event in London. Canceled.

From there, South by Southwest in Austin … you get it. EVERYTHING IS CANCELED.

So I had an inkling this was coming before everyone else. And I see a bigger picture: It’s not that the cancelation of these events will hurt the local economies. It’s that without those events, deals don’t get done. No new connections. No new sales leads. No new business investment. Everything slows down.

Now we’re all going to be working from home for the foreseeable future, and — let’s be honest — worker productivity goes down when people telecommute. On top of that, all the kids are home from school and college, so parents have to babysit.

All this against a backdrop of uncertainty: no one knows how long the Coronavirus pandemic will last, and our nationalistic approach to solving it means we don’t have a good global response. So spending slows down, demand slows down, productivity slows down – all the makings of an extended recession.

I say this all this with no trace of fear. I’m not afraid of the virus. I’m not afraid of recession. I’m not afraid of death. I’m not afraid of losing my job, my business, or my home. I see opportunity everywhere.

SMART INVESTORS SEE OPPORTUNITY EVERYWHERE, ESPECIALLY IN TIMES OF CRISIS.

Note I said “opportunity,” not “opportunistic.” Our mission is to find investing opportunities that bring “health, wealth, and happiness,” as I’ve been signing off every one of my columns since Bitcoin Market Journal began.

I hope the impact of COVID-19 is short-lived. But I believe this is an economic tidal wave that will hit us in stages. So as everyone is fleeing to get out of town, let’s start laying down some sandbags and looking at companies that are not only likely to survive — but to thrive.

The Clorox Company (Stock Ticker: CLX)

Two words: Clorox Wipes.

Every building I enter now has a container of Clorox Wipes and an industrial-sized squirt bottle of Purell hand sanitizer. How can we possibly estimate the sales growth these two companies are going to see this year? There’s one big difference: Purell is a private company. Clorox is public.

(For new investors, that means you can buy shares of Clorox stock using any online brokerage like E*TRADE – but know that we do not provide investing advice, only ideas. Do your own research and never invest more than you’re willing to lose.)

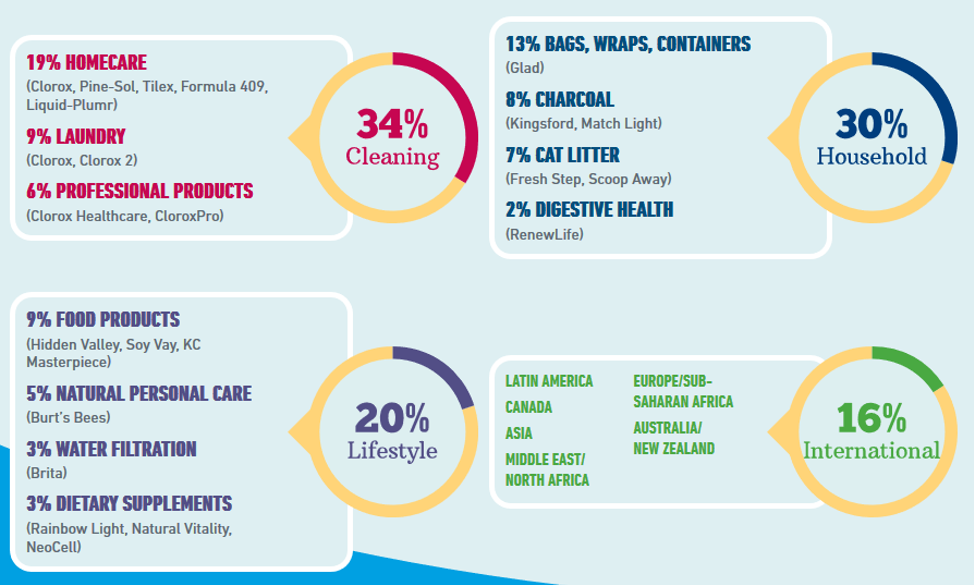

Courtesy Clorox Annual Report

We spent some time digging through the Clorox business, which encompasses a number of household brands — from Glad trash bags to the magnesium supplement Natural Calm (which people are also going to need).

But it’s Clorox-branded products that make up a third of their sales: bleach, spray, wipes, disinfectants, and even the Total 360 System, which looks like something they’d use to disinfect an alien spaceship.

Way back in 2014, the company put together a 2020 Long-Term Strategy, with a 3-5% annual growth target. As of 2019, they were at 2.4%. Given the vast quantities of Clorox that will be consumed in the fight against COVID, I’ll let you decide whether the company will make their goal by the end of 2020.

My vote: Clorox is going to clean up.

Netflix (Stock Ticker: NFLX)

People are being sent home by the millions. Workers. Students. Adults. Children. Babies.

They’re going to get bored.

Parents need a way to babysit the kids? Netflix.

Students finished your three hours of study? Netflix.

Adults trapped at home, can’t go out to eat or the movies? Netflix.

Sure, there are plenty of other streaming video options, not to mention videogames and plain old broadcast TV. But Netflix has a streaming product unlike any other, customized to your viewing preferences, with an enormous amount of quality original content. They’re the leader.

We also looked at other streaming companies, including Disney (whose streaming Disney+ memberships will likely take off), but the closure of Disney theme parks may offset these earnings. Netflix is a pure play: although they still have a small legacy DVD-by-mail business, the real business is streaming.

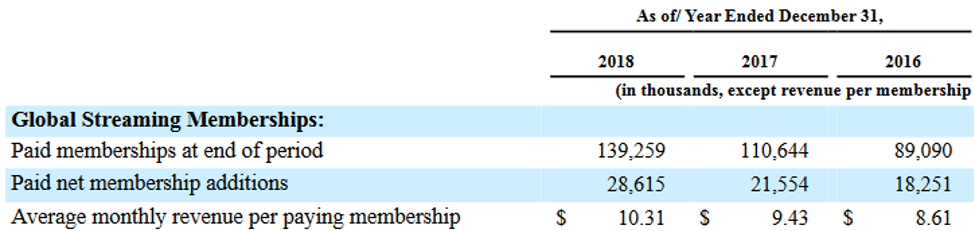

Netflix’s streaming memberships have increased year over year for the past 3 fiscal years, and so has their average membership fee, as you can see here:

Courtesy Netflix annual report

Netflix also reports strong seasonality: when customers buy internet connected devices, they watch more. That’s why Q4 (when everyone is buying new devices for the holidays) and Q1 (when they’re continuing to watch them) are their strongest seasons. Expect that trend to pick up during COVID.

Finally, Netflix is even stronger internationally than it is in the U.S. International memberships make up about 50% more than domestic memberships, making it a great company to capitalize on the international audiences staying at home during COVID-19.

(Funny how the virus doesn’t recognize national or political borders. It just sees one human species.)

Zoom Communications (Stock Ticker: ZM)

There are plenty of videoconferencing systems out there. In my experience, they all suck, except Zoom.

We do a lot of video calls with clients, and we’ve found that most videoconferencing software takes forever to install, doesn’t connect you properly, loses the connection randomly, and just generally provides a terrible experience.

Zoom, in our experience, just works.

As the company said in its offering prospectus, this causes a kind of “viral enthusiasm” among its customers. (If only they knew how literally that phrase would come true!) Over the last week, I have heard so many people — from churches to schools – say, “We’ll Zoom in.” It’s becoming a verb.

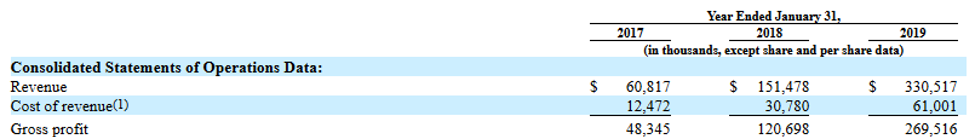

Yes, Zoom is a newly-listed company. But it has had a 5x growth in three years:

Courtesy Zoom Annual Report

It’s the only pure-play videoconference company in the Gartner Magic Quadrant, where it ranks with industry behemoths Microsoft and Cisco. And it has the highest user ratings on the aggregator site G2Crowd:

Courtesy Owl Labs. (Note we also looked at Slack, but found it too young and unproven.)

The Zoom business model, like the Netflix model, is a subscription-based service. The SaaS model means more predictable revenue, since you can look at their number of subscribers, subtract their estimated churn (i.e., lost subscribers), and project their future growth.

Everyone is going virtual. Some people will try to use Google Hangouts or GoToMeeting. But when they get frustrated, guess where they’ll Zoom to next?

Amazon.com (AMZN):

If you think of Amazon as an e-commerce company, you’re wrong. It’s a logistics and infrastructure company. And now is Amazon’s time to shine.

Amazon has one of the most advanced warehousing and distribution networks in the world, not only of physical goods (the stuff you get delivered to your door), but also of data (the stuff you get delivered to your computer).

I know, you thought Amazon had already conquered the world, but you haven’t seen anything yet.

- Think about how com sales will grow, as they deliver millions of packages to people who are staying indoors, electing not to go to the store.

- Think about how Amazon Prime will grow, as people see the opportunity to save on delivery by joining Amazon’s membership service.

- Think about how Amazon Video will grow — like Netflix — as people rent more movies and get access to Amazon’s library of original content.

- Think about how Amazon Web Services will grow with all the videoconferencing, streaming, and online meeting traffic. (For some context, both Netflix and Zoom use AWS.)

- Even Whole Foods, Amazon’s grocery chain, may see a lift, as consumers opt for healthier food options (though the coming economic recession may mean a hit for higher-priced groceries).

The big question is: can Amazon handle the demand?

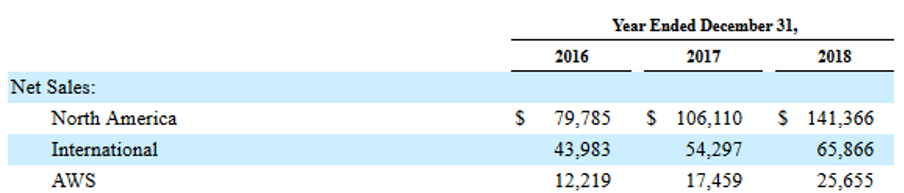

Courtesy Amazon.com Annual Report

For years, Amazon has invested heavily in logistics and infrastructure. Think about the Amazon lockers in your neighborhood, the Amazon Web Services business (which owns about half of the cloud infrastructure market), the endless stream of Amazon packages you see delivered to your neighbors.

Amazon, perhaps more than anyone else, is positioned to profit. They’ve built the pipes that are going to bring us all the essential goods — both physical and virtual — over the coming months and years.

Health, Wealth, and Happiness

This is a time of rare opportunity.

While everyone is running around with their pants on fire, we can calmly assess the market and look for great buying opportunities – either as part of our Blockchain Believers Portfolio, or just as standalone investments.

These are not get-rich-quick opportunities; these are ideas for long-term investments. The full economic effects of the Coronavirus are going to have a “lag factor.” They’ll take a while. Things will likely get much worse before they get better. But eventually things will change: they always do.

Markets are moody. It’s their nature. But we can use reasoned analysis to profit from the market’s moods.

In putting our money into the companies that will help us get through the Coronavirus, we’re also doing something good: we’re investing our money where it’s needed. We’re putting our money to work. And we’re signaling long-term confidence in the stock market.

Of course, the easy way of holding stocks is to simply buy an index fund that tracks the entire stock market (such as VTSMX). But if you’re interested in finding a few winners — especially in times of rare opportunity like this one — then this gives you a few ideas to get started.

I wish you health. I wish you wealth. And above all, I wish you happiness.

Sign up here to get more blockchain intelligence and insight in our free weekly newsletter.