There’s a new way to make money with your crypto assets, and that is to do nothing at all.

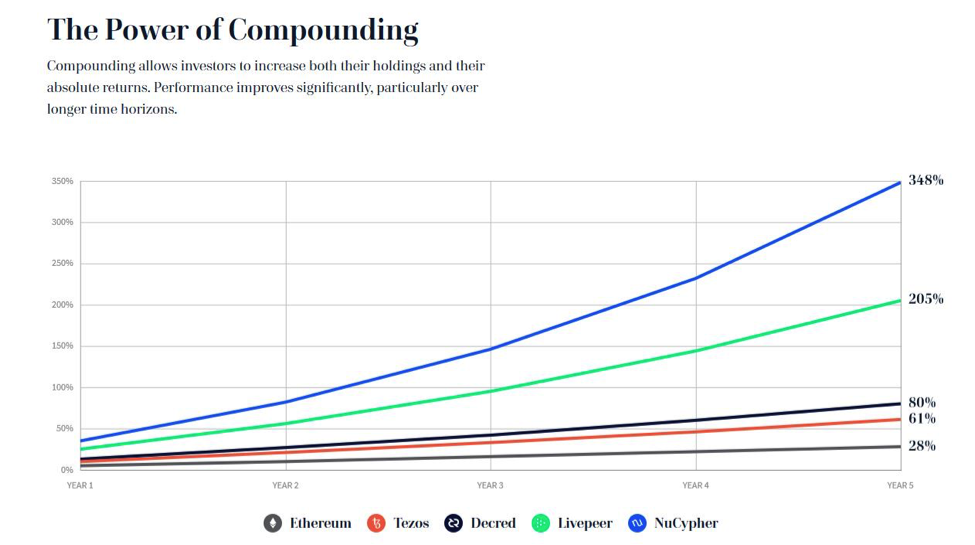

Everyone knows the magic of compounding interest, where you’re earning interest (say, for letting a bank use your money), then earning interest on that interest. As the interest accumulates, it gets automatically reinvested, and earns even more interest.

The blockchain investor’s equivalent is the idea of staking, where you’re earning tokens for holding tokens. To understand how this works, let’s briefly review how certain blockchains use Proof of Stake.

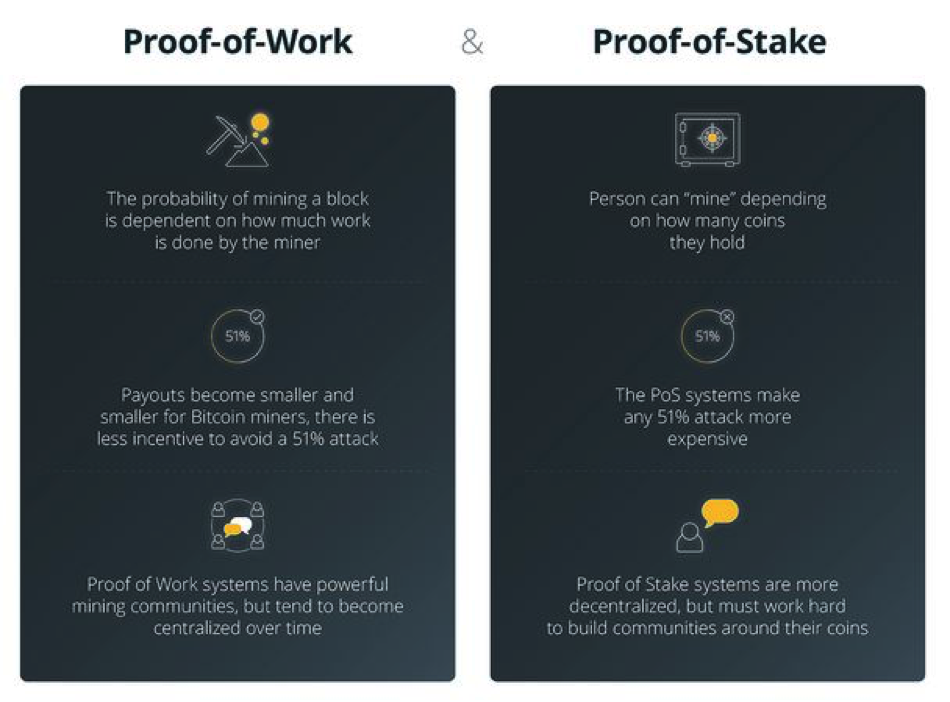

Courtesy CoinTelegraph

In a blockchain running on Proof of Work (like bitcoin), the system requires “miners” to maintain a huge network of computers performing heavy math to validate the blockchain. This consumes enormous amounts of energy and makes Earth sad.

In a blockchain running on Proof of Stake (like Tezos), the system requires “bakers” to simply own the token. The more tokens they hold, the more “votes” they have in validating the blockchain. No energy-intensive computer setup required.

Why would someone want to own tokens in a Proof of Stake model? Because you can earn income—like dividends—on the amount that you “stake.” Think of it like putting your money to work—and it is work, as the process of validating the blockchain is technically complex.

For those who don’t want to go through the hassle, there’s an even simpler way: you can now delegate these assets to someone else, and earn between 5 and 25% annually. Think of it like putting your money into a savings account: the bank puts that money to work, and you split the profits (i.e., interest).

In plain English, here’s how crypto staking works:

- You buy a bunch of Tezos (or some other Proof of Stake token);

- You trust it over to a staking service (like the ones listed below);

- They do the work of staking for you;

- The two of you split the “interest”;

- Rinse and repeat.

Crypto Staking Providers

Several companies have begun to offer “staking as a service,” outlined in the table below.

| Tokens supported | Est. annual return | Protection | |

|---|---|---|---|

| Coinbase Custody | Tezos | 6.6% | Coinbase claims zero risk, as tokens stay in fully-insured cold storage. |

| Battlestar Capital | Dash, Qtum, Decred, Horizen, Tezos, PIVX, GINCoin, Enigma, Green Bitcoin, Cardano, Zcoin | 5% and up | “A unique and secure form of asset custody.” |

| Staked | Tezos, Dash, Decred, Livepeer, Factom and EOS | 5% and up | Non-custodial staking (you don’t hand over your private keys), plus extensive “internal controls.” |

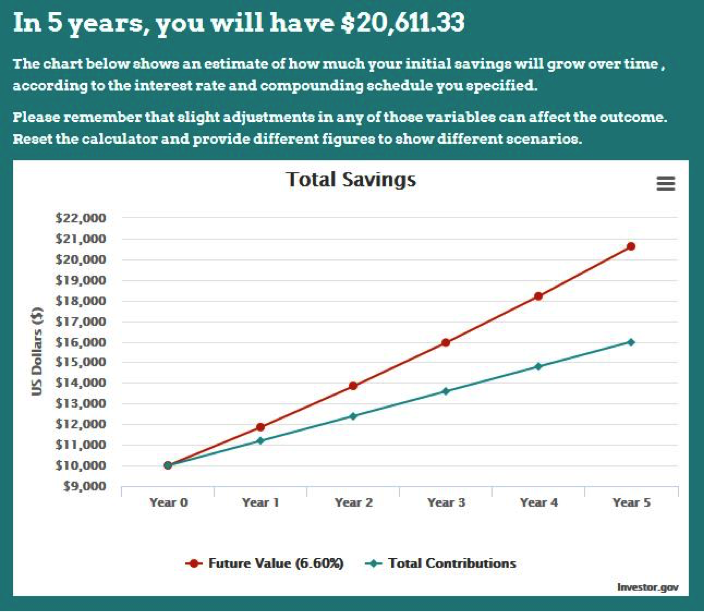

So let’s say that you invest $10,000 in this blockchain investment strategy to start, with a monthly contribution of $100, reinvesting your gains back into your staking account. With the magic of compounding, you will double your initial investment in about five years:

While some of these services claim returns of up to 100% annually, let’s be conservative and say that most investors can expect to see returns in the 5-10% range—on par with the stock market, which averages about a 7% annual return.

Courtesy Investor.gov

Like any investment scenario, this carries a lot of assumptions: blockchain remains a viable investment class; Proof of Stake systems continue to grow; staking providers continue to thrive. There are risks involved, but there’s also the risk of holding onto tokens without ever putting them to work.

Staking is like putting your blockchain portfolio to work. And when your blockchain investments are working hard, maybe you can rest a little easier.

Sign up here to get more blockchain marketing ideas in our free weekly newsletter.