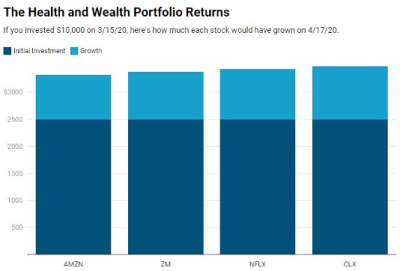

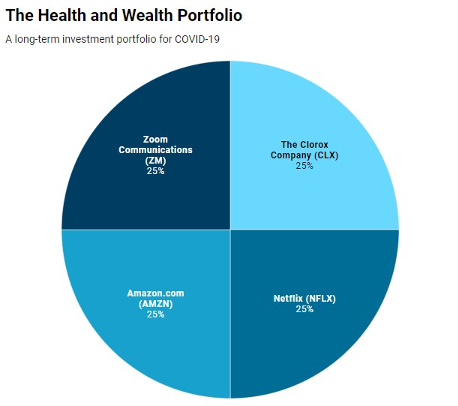

One month ago, I told you about our new Health and Wealth Portfolio, made up of four traditional stocks that would likely do well during the CoronaCrisis:

- Amazon (AMZN), which would deliver all our stuff;

- Netflix (NFLX), which would deliver all our streaming;

- The Clorox Company (CLX), which deliver all our sterilization;

- Zoom Communications (ZM), which would deliver all our staff meetings.

Those results would be impressive if they were annual returns during a healthy economy. To grow that fast in one month during a downturn is mind-blowing.

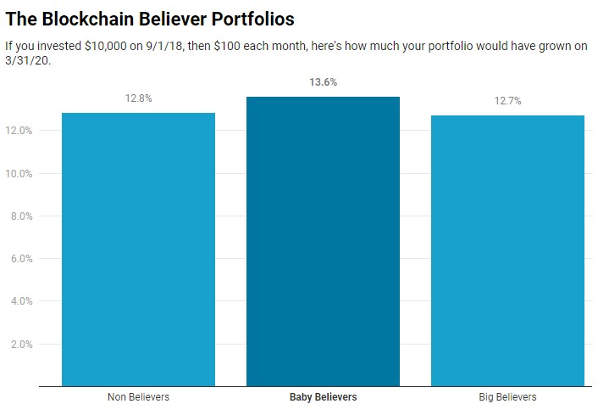

As you know, our philosophy is not “get rich quick” but “get rich slowly.” (Play the long game.) So let’s turn to an update on our other long-term play: the Blockchain Believers Portfolio.

- The Non Believers Portfolio, which is basically 2/3 stocks and 1/3 bonds, is up 12.8% since we began tracking this on September 1, 2018. (This would be your plain-vanilla portfolio with no digital assets, for reference.)

- The Baby Believers Portfolio, which is the same thing but with a tiny slice (2.5%) of bitcoin, has outperformed (13.6% vs. 12.8% growth). That sliver of bitcoin makes a difference, as it helps cushion the stock market fall.

- The Big Believers Portfolio, which has a slightly higher percentage invested into the top 3 (bitcoin, Ethereum, Ripple), has done about the same as the Non Believers (12.7% vs. 12.8% growth).

Since the time we started tracking this portfolio until today:

- Stocks are down -7.2%

- Bitcoin is up +0.1%

This has big implications.

When the CoronaCrisis began, everyone expected bitcoin to be the “safe haven” as people fled the traditional stock market. When it didn’t happen overnight, everyone lost faith. But these things take time.

Think about how hard it still is to buy bitcoin. It’s not like people can just move over stocks to bitcoin in their E*TRADE account (yet). They’re separate markets, with a huge wall between them.

But as governments around the world look for ways to relieve the deepening financial pressure, and investors increase their demand for non-traditional assets, these walls will crumble.

Before we’re through this, bitcoin will finally go mainstream.

There’s Always Opportunity

While there is real suffering with this crisis – from the cost of human lives to widespread economic hardship – there is also opportunity.

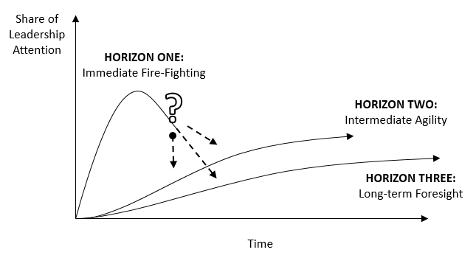

This is the finding of a great article by George Day and Paul Schoemaker recently published by The Wharton School. They outline three principles for how businesses can manage the CoronaCrisis, which can be equally applied to investors:

Principle Two: Be agile. Nobody knows what the future will hold, or how long this recession will last. So we take it One Day at a Time (#ODAT). We adapt. We adjust. We keep tabs on “ground conditions” by talking to a lot of people, observing the world around us, and quickly course-correcting.

Principle Three: Skate to Where the Puck Is Going. As the hockey legend Wayne Gretzky once said, “I skate to where the puck is going, not where it has been.” He had an uncanny ability to foresee a few seconds into the future, as you can see on this vintage VHS-era video:

- Printing money: More nations will use quantitative easing to help their citizens make it through. What will this mean for inflation rates? Will the U.S. remain the dominant reserve currency?

- Economic stimulus incentives: To get industries restarted, governments will likely offer rebates on mortgages, cars, appliances, and other “big ticket” purchases. Which companies will benefit?

- Small business help: To keep workers employed, governments will likely pump more money into small businesses (it’s more expensive in the long run to lay off than to furlough).

- Bailouts: Core infrastructure industries (airlines and potentially banks) will need help staying afloat. Who will receive bailouts first? How will these industries change in a few years?

- Digitization of money: We’ve seen the pain of quickly getting all this money into the hands of the people who need it. How will this speed up the development of a “digital dollar”?

- Globalization of money: As we’ve discussed over the past few weeks, a global crisis requires a global response. Expect to see the IMF take a bigger role in overseeing a kind of “world money.”

This is a lot to think about. But the principles are to put out immediate fires, play the long game, and invest in the opportunity.

The entire world order is changing. Opportunities are everywhere.

Sign up here to get more blockchain intelligence and insight in our free weekly newsletter.