I am proud to announce the biggest project we’ve undertaken at Bitcoin Market Journal: our new Digital Asset Rankings. Think of them like “stock ratings for tokens.”

The project started last year, after we developed our industry-leading Blockchain Investor Scorecard. “What if we used this to create a list of top tokens, kind of like a Morningstar or Moody’s rating system?” I asked our editor Alex Lielacher.

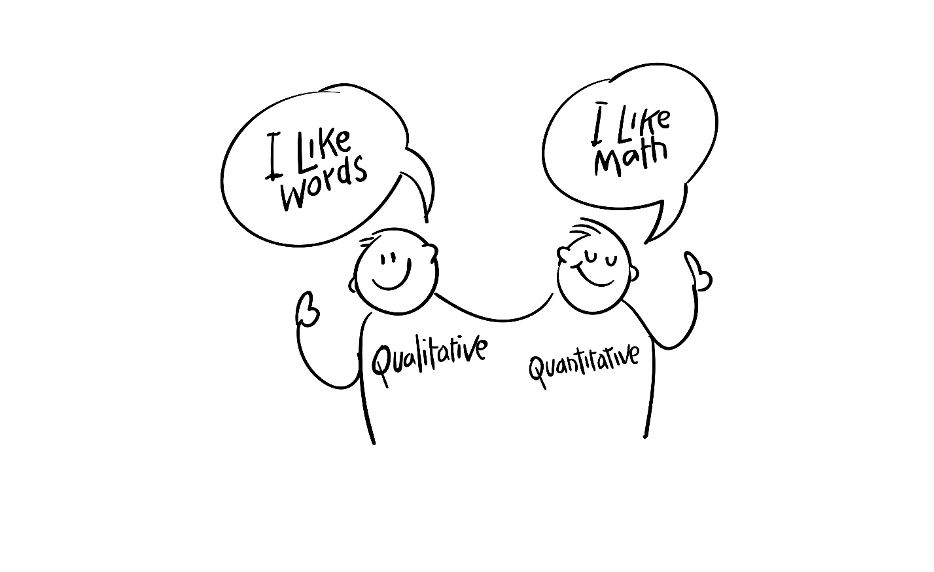

“The Blockchain Investor Scorecard is great,” said Alex, “but it’s a qualitative analysis, which is only half the picture. We also need some kind of quantitative metrics.”

“The conjoined twins of investing,” I nodded, remembering the image from my book (pictured above).

“Maybe we could find metrics that would serve like market indicators,” suggested our analyst Kevin Kelly, “in the same way that stock investors use metrics like Earnings Per Share.”

Everyone agreed this was a good idea.

In hindsight, it was a good idea, but we had no idea how difficult this good idea would be.

First, there are no commonly agreed metrics for Digital Assets (i.e., tokens or cryptocurrencies), so we had to build everything from scratch. And that’s just math: when it comes to “matters of opinion,” as in our Blockchain Investor Scorecard, everyone had an opinion. (Just ask Twitter.)

So Alex, Kevin, and our analysts Justin Caldwell and Adam Carpenter used our Blockchain Investor Scorecard, combined with an internal review process of thoughtful debate, helping us “find the truth together.” (Thanks to Ray Dalio for this principle.)

We are incredibly proud of what we’ve accomplished, which we’re making available to everyone, free of charge. Click here to check out our new Digital Asset Rankings.

Three principles guided our work.

Principle 1: Usability

In a nutshell, our goal is to give you each digital asset in a nutshell. Helpful star ratings (our overall, deep-dive qualitative rating) are complemented by one or more quantitative metrics.

By having multiple data points for each asset, you can more quickly determine at a glance whether a token is worth considering in your investment portfolio—without poring over dictionary-sized books, or wading through 60-minute YouTube videos.

Each column is sortable. For example, you can sort by Token Velocity to see which tokens are changing hands most frequently. Liquidity is a good data point for whether a digital asset has a lot of active buyers and sellers – but liquidity alone would not be a reason for buying or selling.

By cross-checking liquidity with our star ratings, however, you get a better picture of the overall strength of a digital asset as a potential investment. If you’re interested, click to dig into our full scorecard rating. We’ve designed our rating system for usability.

Principle 2: Quality

Our goal is digital asset ratings that reflect reality, rather than overhyping a token that we’re getting paid to promote. (At Bitcoin Market Journal, we don’t accept any paid promotion.) In other words, we’re trying to identify investments that are likely to grow in the future.

To do this, we used our Blockchain Investor Scorecard, which is our open-source scorecard that is used to deep-dive on the most important aspects of a blockchain-based digital asset. (Learn more about the Blockchain Investor Scorecard here.)

We complemented this with our three ratios — NVM Ratio, NVT Ratio, and Token Velocity — which you can view like stock fundamentals. Note that not all digital assets have NVM or NVT, because not all digital assets have transparent blockchains — which brings us to our last principle.

Principle 3: Transparency

Our goal is an open-source rating system that anyone can use. We want to be radically transparent with how we get to our ratings. You may not agree, but you at least can see our expert thinking that went into it.

We believe that the days of closed, proprietary, secret rating systems are over. They lead to systemic problems where the entire economy becomes “pay to play,” as illustrated in this great scene from The Big Short:

Unlike Wall Street, we will not sell ratings for fees.

The Telescope and the Microscope View

What our team – Alex, Kevin, Justin, Adam, and myself – bring to the table is a deep knowledge of blockchain, and a broad understanding of different assets. We’ve seen a lot of stuff. This gives us both the “telescope” and the “microscope”: the big picture and the detail view.

That said, we are not perfect. Any rating system is necessarily subjective. But by using our transparent, open-source approach, you can see how we got to our conclusions, then make your own.

As always, our blockchain investing principles apply:

- Do your homework before making any investments. Discuss ideas with other smart people (in person, not on social media).

- Don’t invest more than you’re willing to lose. Blockchain investing can be a roller coaster.

- Diversify, diversify, diversify. See our Blockchain Believer’s Portfolio for simple allocations.

- Consider digital assets a “slice of the pie,” your alternative assets or “mad money.”

- Grow the pie. Contribute to your investment portfolio in “steady drip payments,” preferably through an automatic monthly withdrawal.

The Industry Standard

Our goal is for this approach – focused on quality, usefulness, and transparency – to become the industry standard. It’s way better than how the economy is run today, and it’s a massive step forward for ordinary investors like you and me.

Remember: we’re giving all this work away, absolutely free. It’s our gift to investors, our gift to government regulators, and our gift to the world.

All we ask in return is that you check it out. And if you find it useful, share it with a friend.

P.S.: Sign up for our newsletter to find out when there’s news on our rankings.