Shortly after I published my book BLOCKCHAIN FOR EVERYONE, I received a sales call from a financial advisor. Instead of listening to his pitch, however, I decided to tell about the multitude of investment opportunities in the blockchain space.

Here’s what happened!

When Old Finance Calls “New Finance”

“Hello John. This is Bobby from [FAMOUS FINANCIAL FIRM] Wealth Advisors. Did I catch you at a bad time?”

I kicked myself for picking up. “Bobby, is this a sales call?”

“I thought you might be interested in hearing how [FAMOUS FINANCIAL FIRM] can help you manage your assets.”

When I’m tricked into answering a sales call, I have a little trick of my own: I flip the script and try to sell them something.

“Listen, Bobby. I just released a new book, BLOCKCHAIN FOR EVERYONE. It’s already an Audible bestseller. How much do you advise your clients on blockchain investing?”

Long pause. “What is blockchain investing?”

“Blockchain investing,” I repeated. “Bitcoin, altcoins, cryptocurrencies. A new asset class. They’re blowing away the stock market.”

He snorted. “That’s all speculation.”

“Today you call it speculating, tomorrow you’ll call it investing. How much have you grown your clients’ wealth portfolios over the last four years?”

“My clients are doing just fine.”

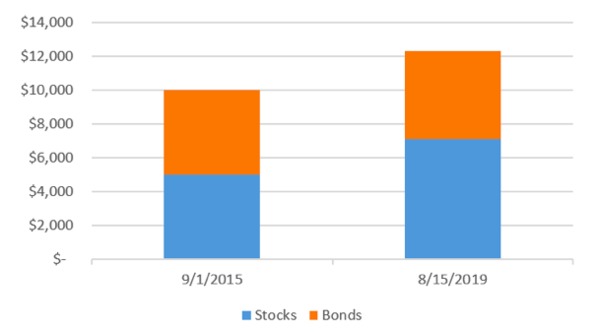

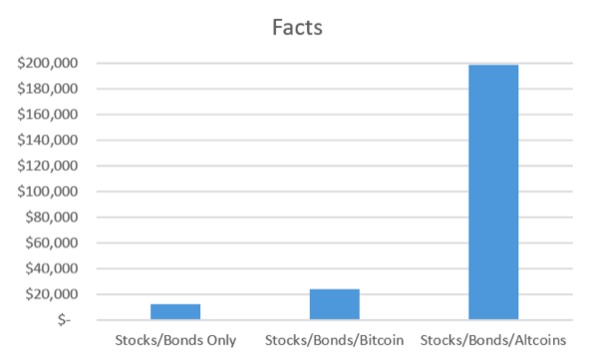

I had my numbers ready to go. “Let’s say your clients invested $10,000 in a plain vanilla portfolio of stocks and bonds in 2015. Today you’d have about $12,000. That’s an increase of how much? I’m bad at math.”

“$2,000,” he responded stiffly. “Twenty percent.”

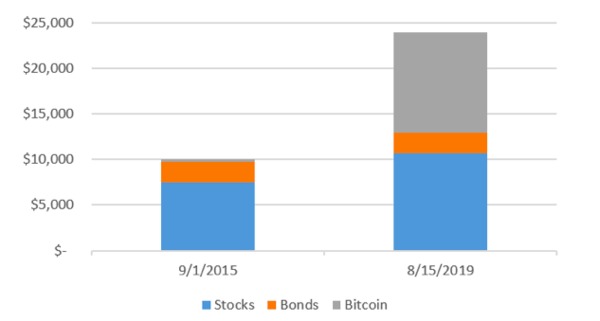

“Now if you had put just a tiny slice of that into bitcoin — just 2.5% — your clients would have doubled those returns. $10,000 would now be worth $24,000. In four years!”

“Right, and bitcoin has cut its value in half since 2017. I’m not signing my clients up for that kind of roller coaster.”

“That why you hedge risk by only buying a small amount. Isn’t it even riskier to leave all this money on the table?”

“No,” he shot back.

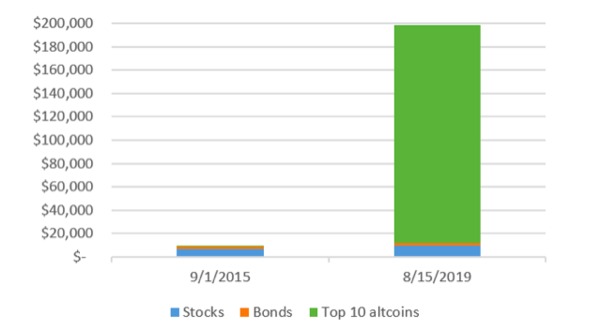

“Now, let’s say you had put 10 percent of your $10,000 into the top 10 altcoins – the top 10 cryptocurrencies – four years ago,” I continued, undeterred. “Just $1,000 invested in bitcoin, Ethereum, Ripple, and so on. The rest in stocks and bonds. Do you know how much you’d have?”

“Look, I don’t have all day—”

“$200,000!” I shouted jubilantly. “Your clients’ $10,000 would have grown into TWO HUNDRED THOUSAND DOLLARS.”

“Look, you can mint your funny money all you want,” he cut me off. “Your – what are they called? – your tokens. Your coins. Real money is printed by sovereign governments.”

“Not true,” I replied. “We can use anything as money, as long as we all trust and agree on it. All covered in my book.”

“This is nothing new. I heard about this bitcoin stuff back in 2014…”

“Did you buy any?”

“What? No!” Preposterous.

“Why not?”

“I buy real things, like gold. My clients who bought gold ten years ago bought it at $1,000. The price of gold is now over $1,500.”

“Some people call bitcoin digital gold,” I went on. “Same qualities, but much better returns. All covered in my book.”

“Look, I’m not going to buy into this [EXPLETIVE].” I couldn’t believe the wealth manager from the famous financial firm was now swearing at me. “It’s a fad.”

“A ten-year fad?” I asked.

“It’s a bubble, like Pokemons or tulips. Maybe you’re right. Maybe I should know more about this stuff, but I’m too busy making money for my clients.”

This was the opening I needed. “You’re right that you need to know more about this stuff. To make money for your clients, you’ve got to be at the top of your game. And that requires learning. You’ve got to be a lifelong learner.”

“Well, time is money,” he said, trying to wrap up the call. Now he was the one who wanted to hang up.

“I am willing to come to [FAMOUS FINANCIAL FIRM] and give your team a training session on blockchain investing,” I offered. “No charge. I want to help you learn.”

“Maybe I’ll get the book,” he countered. “What’s it called again?”

“BLOCKCHAIN FOR EVERYONE. Now, listen Bobby. Learning is literally your job. Your clients are paying you to learn, so you can help them separate the good investments from the bad.”

“That’s why I got my clients into silver,” he began. “Over the last four years…”

“…the price of silver barely moved,” I continued. “That’s because it’s a METAL. You dig it out of the GROUND, with a SHOVEL. Did you also advise your clients to invest in FOSSILS?!”

This was too much for him. “I don’t need any of your [EXPLETIVE] bitcoin, your cryptos, to make money. You know, maybe I should have bought some. Maybe I don’t know what I’m talking about. But maybe this is all going to come crashing down.”

“And maybe the stock market will come crashing down,” I responded coolly. “It will happen eventually. And then your clients will be looking for alternative investments. Don’t you think you should learn something about blockchain investing?”

“Well, time is money,” he repeated. “I’ve got more phone calls to make today, so…”

“What do you say, Bobby?” I asked him, looking him up on LinkedIn. “You’re an SVP at [FAMOUS FINANCIAL FIRM]. Can I offer you a free training session for your team?”

“We’ll think about it,” he responded. “But really, I have to go. Thanks for the spirited debate.”

“It wasn’t really a debate,” I told him. “I was just explaining facts.”

Old Finance Needs Blockchain Education

Our conversation was a perfect snapshot of my experience with the financial services industry. We’re paying these guys (mostly guys) to advise us on new investing opportunities, and they’re unwilling to learn about new investing opportunities.

To teach more financial services professionals about blockchain investing, Bitcoin Market Journal ran a free giveaway of my book to BMJ newsletter subscribers who work in the financial industry. Two financiers actually took us up on the offer!

Let’s hope more will follow in their footsteps and learn about investment opportunities in the blockchain industry.

Sign up here to get more bitcoin intelligence and insight in our free weekly newsletter.