When I finished writing my book BLOCKCHAIN FOR EVERYONE last fall, I started a little experiment.

The experiment was to see if the book would come true.

In the book, I suggested that if everyday investors held a small percentage of bitcoin and altcoins in their portfolio (between 2 and 10 percent), they would see much better returns than investors who invested only in stocks and bonds.

It was easy to show this was true for the past: bitcoin had historically blown away the stock market. But past performance is no guarantee of future results, as Fidelity constantly reminds us. Would my prediction hold true in the future?

Since Q3/2018, we have been diligently tracking the results of our “Blockchain Believers Portfolio,” and the one-year returns are finally in.

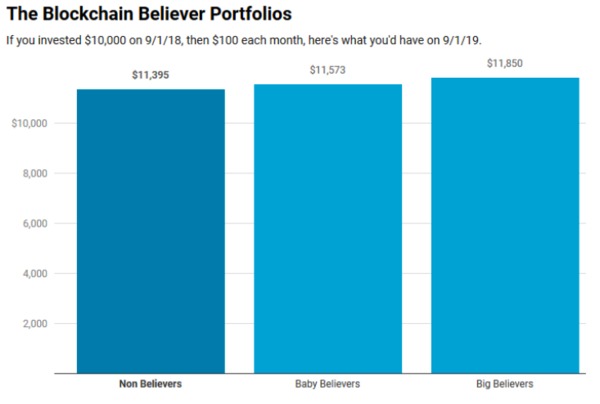

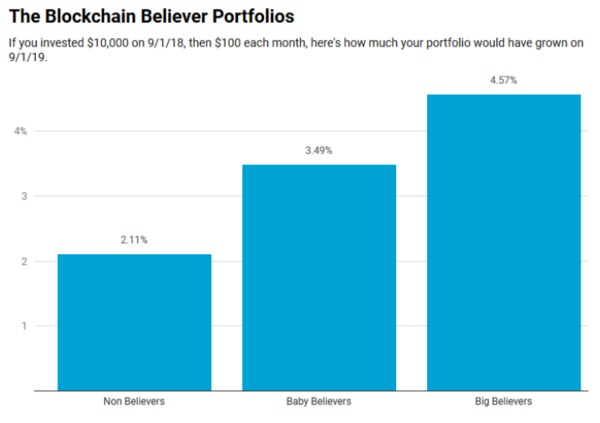

Buying just a little bit of blockchain (10%) has doubled the returns over a traditional investment portfolio. The book has come true.

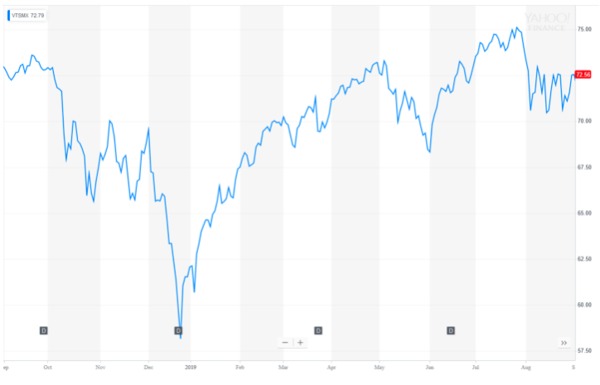

By itself, the stock market has remained flat over the last year, which is why so many analysts are worried about the state of the U.S. economy. $10,000 invested in the stock market on 9/1/18 would be worth about $10,000 on 9/1/19 (click for chart):

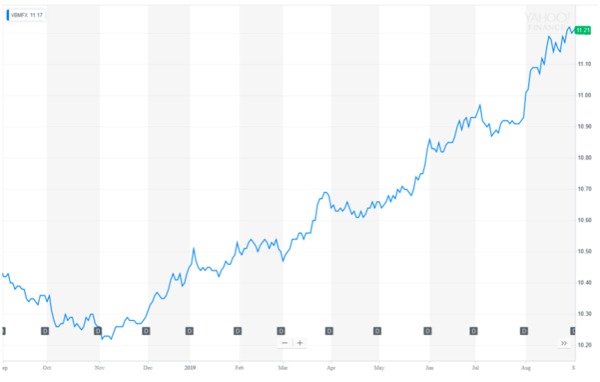

Compare this chart with the overall bond market, which is steadily on the rise. Investors who held a “plain vanilla” portfolio of stocks and bonds would have seen an increase, solely because of the rising price of bonds (click for chart):

Since rising bond prices are often caused by jittery investors, this can be a sign that a recession is coming. But is it?

In Case of Recession, Don’t Panic

If a recession is on its way (as the New York Times predicts), what will that mean for the price of bitcoin?

One theory is that as investors grow increasingly nervous about a worldwide recession, they will start to flee to “safe havens” – including, possibly, digital assets. Just as investors buy gold during a recession, the thinking goes, they will also buy “digital gold” in the form of bitcoin, driving up the price.

On one hand, the price of bitcoin is much more volatile than the price of gold, so the comparison is not quite accurate. On the other hand, bitcoin may offer the safety of gold (it’s not heavily correlated with the stock market) with the speculative properties of a new asset.

In other words, this may already be happening.

Summary of One-Year Returns

- “Non Believers” who invested 65%/35% in stocks/bonds saw a 2.1% increase;

- “Baby Believers” who invested 65% in stocks, 32.5% in bonds, and 2.5% in bitcoin saw a 3.5% increase;

- “Big Believers” who invested 65% in stocks, 25% in bonds, and 10% in the top 3 altcoins saw a 4.5% increase.

- All three portfolios assume you are socking away $100 each month, a strategy we call “steady drip investing.”

- The full investing strategy here.

As Publishers Weekly summarized in their review of BLOCKCHAIN FOR EVERYONE:

Discussing incorporating the practice into one’s investment portfolio without risking everything, [Hargrave] talks about what the upper limits of the cryptocurrency boom might be, including the rise, fall, and rise that have already happened. His larger goal—encouraging more people to invest in bitcoin so the industry can grow more sustainably than in the past—is laudable.

They said it better than I could: As more people invest in bitcoin, the industry will grow more sustainably.

To which I will add: As more people invest in bitcoin, their personal wealth has already grown more sustainably.

The book has come true.

Subscribe to our newsletter to stay up-to-date with the latest trends and developments in the digital asset markets.