What a time in history!

Whether it is the United States House talking about Satoshi Nakamoto or seeing the President tweeting about cryptocurrency, it feels like blockchain has finally gone mainstream. If we were surfers, it’s like we’ve all been on our surfboards for the past few years, just waiting for the perfect wave—and in 2019, it finally came rolling in.

We also witnessed U.S. Senate Banking Committee, as well as the House Banking Committee, grill Facebook executive David Marcus on the plans for Libra, the new digital money hatched at Facebook. Marcus endured hours of relentless interrogation, and he held up like a champ.

The government’s concerns boil down to one central problem: digital currencies threaten the global power of the U.S. dollar.

This is a new era in U.S. politics, with both parties coming together to either support or oppose digital currencies. Both the far left and far right believe in individual and personal freedom: they are largely bitcoin believers. Those who want to maintain the existing system – conservatives, liberals, and moderates – are largely opposed.

Finally, we have found a cause that unites our political parties. (Is there anything blockchain can’t do?)

Let’s divide United States politicians into two new “supergroups,” which we’ll call the Blockchain Believers (in support of decentralized digital currencies), and the Dollar Defenders (who want to maintain centralized control).

Here’s a sampling of their thoughts as they put the new Libra digital money under the microscope.

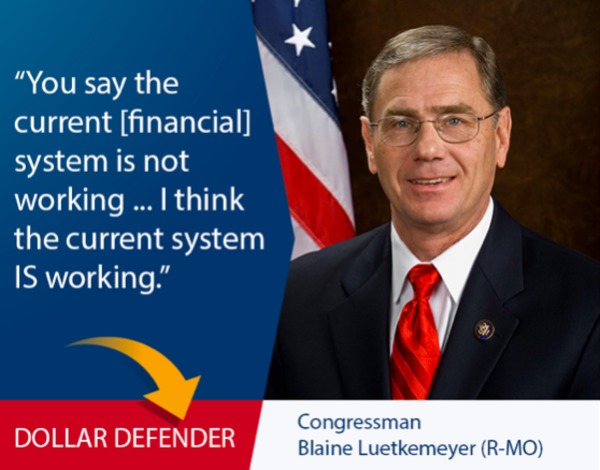

The Dollar Defenders (Opposed to Digital Money)

It was Missouri Congressman Blaine Luetkemeyer (R-MO) who most clearly defended the status quo: “You said that the current [financial] system is not working … I think the current system IS working. The system right now works because it’s like traffic control.”

The key word in this sentence is “control.” Centralized governments want to control a centralized currency. The question is how centralized governments control a decentralized currency, which Libra ultimately aims to become.

Carolyn Maloney (D-NY) went so far as to say, “I don’t think you should launch Libra at all. The creation of a new currency is a core government function.” She was joined by her fellow Congresswoman Nydia Velázquez (D-NY), who said: “We want to make sure that companies [like Libra] … could not threaten the U.S. financial system.”

The two New York congresswomen called on Marcus to stop Libra until they could figure everything out. “This is not Silicon Valley,” Velázquez pointed out. “You cannot work out problems as you go.” (Did the United States work out all its problems before it launched?)

It was Congressman Brad Sherman (D-CA) who said it most clearly. “America’s power comes from the power of the dollar more than the power of our military … Cross-border transmission? Let’s do that, in dollars!”

In other words: defend the dollar.

The Blockchain Believers (Open to Digital Money)

Patrick McHenry (R-NC) gave the most impassioned and intelligent response to Libra. “Washington must ensure that it’s not the place where innovation goes to die. Just because we may not understand a new technology proposal does not mean we should immediately call for its prohibition.” He pointed out that the genie is out of the bottle: “The reality is that whether Facebook is involved or not, change is here. Digital currencies exist. Blockchain technology is real.”

“We should not attempt to deter this innovation,” he went on. “And governments cannot stop this innovation. And those that try have already failed. Instead of a kneejerk reaction of banning something before it begins, my colleagues and I want to try to first understand it.”

Sean Duffy (R-WI) called Libra “absolutely brilliant. Innovative, creative … and pretty amazing.” He went even further, arguing that Libra should be open to everyone, just like a $20 bill. It should “behave like a fiat currency,” he proclaimed, holding up a $20 bill to make his point. “The freedom and liberty that comes with the $20 bill,” he went on, “I think you should offer the same freedom and liberty on your [Libra] network.”

Steve Stiver (R-OH) understood the promise of global money: “The value I see in this innovation is cross-border payments, because that’s so expensive today. About 60% of the world’s population lives in a country that does not have a stable currency.” (Not sure about his math there.) “Helping the unbanked and helping people with cross-border payments … I appreciate the innovation.”

Finally, it was French Hill (R-AR) who articulated the blockchain philosophy in just three words: “Trust, but verify.” He even held up a coffee mug with this slogan on it.

Trust but Verify

But it was Andy Barr (R-KY) who actually talked about financial inclusion, which is the problem that Libra is reportedly trying to solve. “I think we should presume that innovation is good, that it presents enormous opportunity for financial inclusion,” he concluded. “I think that the opportunity for financial inclusion with Project Libra is enormous and very positive.”

This is what our elected politicians should be doing: figuring out the biggest problems facing society, and discussing possible solutions. I can’t tell you whether Libra will actually become global money that helps the unbanked. But I can tell you that financial inclusion is a problem – one-fifth of the world is unbanked – and only global money will lead to global inclusion. One money for one world.

Trusting, but verifying. Now that you’ve verified their stances, which side do you trust?

Sign up here to get more blockchain intelligence and insight in our free weekly newsletter.